Investments in Renewable Energy

Calculate investments in renewable energy.

Renewable energy - like the sun or wind - are available for free, but the equipment required to use the energy is not.

The economy in a renewable energy project can be calculated with alternative methods - the most common are

- payback time

- simple annual method

- discounted cash flow

Payback Time

Payback time - the time it takes to save or earn an amount equal to the investment - can be calculated as

t = I / A

= I / (E c) (1)

where

t = payback time (years)

I = investment

A = annual net income - or savings - from the investment

E = energy produced or saved per year (kWh/year)

c = cost or savings per energy unit (1/kWh)

Example - An Investment in a Windmill Generator

An amount of 100000 is invested in a windmill generator. The windmill is assumed to produce 8000 kWh/year . The cost to buy this energy from the local grid is 1 per kWh .

The savings on produced energy can be calculated as

A = (8000 kWh/year) (1 1/kWh)

= 8000

The payback time can be calculated to

t = 100000 / 8000

= 12.5 year

Renewable Energy - Payback Time Calculator

Simple Annual Method

The economy alternatively be evaluated by calculating the cost of the energy produced or saved. The cost of energy can be calculated as

c = (I / y + C) / E (2)

where

c = cost or savings per energy unit (1/kWh)

I = investment

y = investment lifetime (years)

C = average annual running costs (1/year)

E = energy produced or saved per year (kWh/year)

Example - An Investment in Solar Panels

An amount of 50000 is invested in a solar panel system with estimated annual energy production of 4000 kWh/year. The lifespan for the system is estimated to 25 year . The average annual cost to operate the system is assumed to be 1200 per year .

The cost of the produced energy can be calculated as

c = ((50000) / (25 years) + (1200 1/year)) / (4000 kWh/year)

= 0.8 1/kWh

Renewable Energy - Simple Annual Method Calculator

Discounted Cash Flow

Since money earned or spend in the future is not worth the same as money earned or spend today - it is common to discount the future cash flow back to a present value. The present value of the cash flows in a renewable project can be calculated as

P = F0 / (1 + i)0 + F1 / (1 + i)1 + F2 / (1 + i)2 + .... + Fn / (1 + i)n (3)

where

P = present value

F = cash flow

i = real interest rate

A renewable energy project typically start with a huge investment in the beginning continuing with smaller income and running costs. The cash flow for a typical year can be expressed as

Fn = En cn - Cn (3a)

where

Fn = cash flow per year (1/year)

En = energy produced or saved per year (kWh/year)

cn = costs or savings per energy unit (1/kWh)

Cn = running costs (1/year)

The real interest can be calculated as

in = (1 + imn) / (1 + iin ) - 1 (3b)

where

in = nominal interest rate

imn = real monetary interest rate

iin = rate of inflation

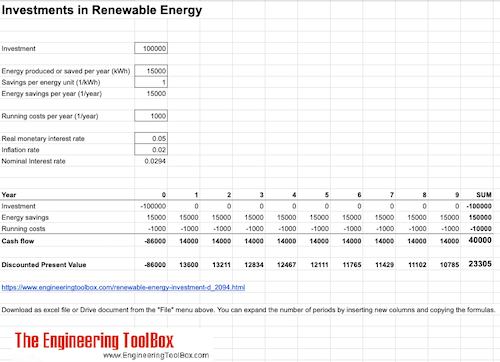

Example - Investment in Renewable Energy and Discounted Cash Flow

An investment of 100000 saves 15000 kWh/year in energy. The energy cost is 1 per kWh , running costs to operate the system is 1000 , inflation rate is 0.02 (2%) and the monetary interest rate is 0.05 (5%) .

A discounted present value for the project over 10 years can be calculated to 23305 as indicated in the Google spreadsheet below.

You can download a copy of the spreadsheet as an excel file to your computer or to your Google Drive. You are free to modify and use the copy as you want.