Net Present Worth (NPW) of a Cash Stream

The value of a stream of payments is called the Net Present Worth (NPW).

The present value of a stream of payments - Net Present Worth (NPW) or Net Present Value (NPV) -

can be calculated with a discounting rate

P = F0 / (1 + i)0 + F1 / (1 + i)1 + F2 / (1 + i)2 + .... + Fn / (1 + i)n (1)

where

P = Net Present Worth (or Value)

F = cash flow in the future

i = discounting rate

(1 + i)n is known as the "compound amount factor ".

Example - the Net Present Worth of an Investment Transaction with a variable Cash Flow

The Net Present Worth - NPW - of investing an amount of 1000 today and saving 250, 200, 300, 310 and 290 the next 5 years - and selling the investment for 310 in the last fifth year - at an interest or discount rate of 10% , can be calculated as

P = (-1000) / (1 + 0.1)0 + (250) / (1 + 0.1)1 + (200) / (1 + 0.1)2 + (300) / (1 + 0.1)3 + (310) / (1 + 0.1)4 + (290 + 310) / (1 + 0.1)5

= 202

Net Present Worth is positive and the investment is profitable.

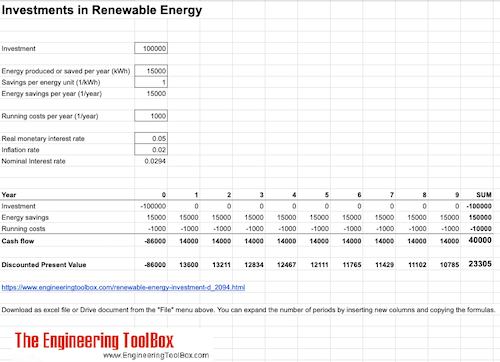

Example - Investment In Renewable Energy - Discounted Cash Flow

- how to calculate discounted net present value in a typical renewable energy project

Net Present Worth Calculator - Variable Cash Flow Stream

The calculator below can be used to estimate Net Present Wort - NPW - in an investment project with up to 20 periods and variable cash flows.

- money out - negative values

- money in - positive values

| Period | Cash Flow | Cash Flow (discounted) |

|---|---|---|

| 0 | ||

| 1 | ||

| 2 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 6 | ||

| 7 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 16 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| 20 | ||

| SUM | ||

| Discount rate (%) | ||

Net Present Worth Calculator - Investment with Fixed Cash Flow and Growth Rate

The calculator below can be used to calculate the Net Present Worth for a project with a fixed investment value and fixed return cash flows with a growth rate.

Example - Investing in a Solar Power System

An investment of 30000 in a solar power system saves an amount of 1000 on the electricity bill the first year. The electricity price is in the future assumed to rise 10% (growth rate) each year. The alternative use of the money is to invest in a savings account with 3% interest rate (discount rate).

The lifespan of the solar power system is estimated to 20 years (no. of periods).

Using these values in the calculator above gives

P = 12819

IRR = 6.1 %

- and the investment is profitable compared to the savings account.

Using the same values - but for a shorter lifespan of 15 years - gives

P = - 3581

IRR = 1.6 %

- and the investment is not profitable compared to the savings account.

Net Present Value - Spreadsheet

A flexible Net Present Value and Internal Rate Calculator in Excel spreadsheet format is available here !